See the ROI of safety programs and the real cost of injuries

Safety ROI Calculator →Risk Management Software

for Small Business

Lower your insurance costs with proactive risk control that prevents claims and earns you better rates. Here's how:

Our AI assisted assessment uncovers risks and delivers an actionable plan in minutes

Create risk control and safety programs with a few clicks

With our built-in Training Director you have everything you need to train your team

With our app businesses can quickly assess and improve their insurable risk.

We Know How to Stop Claims

The evidence is clear: businesses with structured safety programs have dramatically better outcomes. A major 2011 study by the Ohio Bureau of Workers' Compensation found that businesses with written safety programs had:

But most small businesses never implement these programs. WHY?

Traditional risk control and safety solutions are built for large enterprises -- with consultants, audits, and long reports that take weeks or months and cost thousands of dollars. That model doesn't work for small businesses.

Smarter Risk's risk management software for small business can help you achieve those outcomes -- without the cost or complexity.

Learn more about why Smarter Risk is in a league of its own compared to traditional risk management software.

Affordable Risk Management Software for Small Business

Smarter Risk gives every small business the power of a full safety program -- without the complexity, consultants, or cost:

Would you like to know the potential ROI when you implement a safety program? Click here to use our Safety ROI Calculator.

Claims Are The Problem

Claims don't just hit your wallet -- they impact morale, productivity, and your insurance eligibility:

Claims Affect Employees

Claims directly impact the well-being of your employees and the morale of your team.

Claims Increase Your Premiums

Claims have a direct impact on how much you pay for insurance.

Claims Limit Your Choices

Claims mean fewer insurance companies are willing to cover your business or even provide you with a quote.

A Challenge We Understand

Traditional risk control and safety consulting doesn't work for most small businesses:

Specialized Training Required

Requires a professional with specialized training

Hours With a Consultant

Requires you to spend hours with a consultant

Too Expensive

Risk control and safety services are expensive

Why Spend $10,000 When You Can Spend $500?

Get enterprise-level risk management tools designed specifically for small businesses -- for less than the cost of one claim.

Traditional Safety Costs

| Service | Typical Cost |

|---|---|

| Risk Assessment | $150 per location |

| Written Safety Program | $5,000 with consultant |

| Safety Training (per employee) | $250 - $1,000 annually |

| Total | $10,000+ |

With Smarter Risk: $500/year

Less than the cost of a single claim

Risk Management Software Made for Small Business

Our web-based risk management software works on any device. No download required.

Risk Control 2.0

Simplified Risk Control and Safety:

Assess

Our risk management software completes assessments in minutes and shows exactly how to improve your risk.

Improve

Use our small business tools to quickly improve your risk, build your safety program, and train your team.

Share

Share your risk report with your insurance partners and demonstrate your commitment to safety.

Fast, Inexpensive, Convenient

The ROI of Safety

Investing in safety and risk management programs has a proven ROI. OSHA estimates employers save $4 to $6 for every dollar spent on safety. Safety programs also boost employee morale and productivity, improving your bottom line.

Case Study: Tool and Equipment Company

A tool and equipment company transformed their organization by completing a comprehensive risk assessment and building safety and risk control programs to manage and mitigate identified risks. In just 15 months, they reduced workplace accidents by 80%, saving $250,000 in workers' compensation costs.

The Importance of

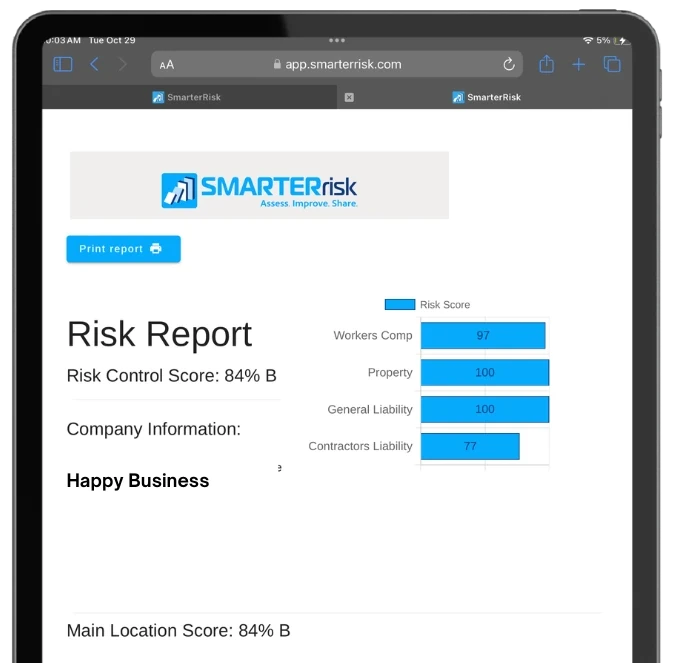

A Risk Report

Before applying for insurance or renewing your policy, complete a free risk assessment with our simple web app. It identifies hazards and provides clear, actionable steps to mitigate or manage them.

Implement those recommendations to instantly improve your score and report. With one click, generate your professional Risk Report -- formatted in a way underwriters recognize and trust.

Show insurance partners you're actively managing risk -- and deserve the best rates.

*Our web-app works on any device. No download required.

How It Works

Step 1: Assessment

Quickly complete a self-assessment, get an instant risk score, and recommendations. If you have questions, get instant help from RISK-B, our built-in AI safety expert.

Step 2: Instant Plan

Your Risk Improvement Plan is generated immediately, giving you a clear roadmap to reduce risk and prevent claims.

Step 3: Safety Program

Create professional-grade safety and risk control policies in seconds. Our Policy Builder references industry standards like OSHA, NFPA, ANSI, and ISO.

Step 4: Track & Document

Check off completed tasks and upload photos to validate your improvements. Your risk report and score improve in real time, instantly documenting progress.

Step 5: Train

Our Training Library provides editable, ready-to-use PowerPoint safety trainings. Get your team trained quickly.

Step 6: Share

Export a standardized Risk Report including your risk score, completed actions, and photo documentation. Perfect for showing agents or carriers that you're actively managing risk.

Watch Our Demo Video!

Frequently Asked Questions

1. Is Smarter Risk designed for small businesses?

Yes -- Smarter Risk is purpose-built for small and mid-sized businesses. It replaces expensive consultants and long audits with a simple, digital process that makes professional risk control and safety accessible to all businesses.

2. How much time is required from my team?

Minimal. Your risk assessment takes 15 minutes or less, and your custom Risk Improvement Plan is generated automatically. Each safety policy can be created in just a few clicks, saving your team time and ensuring you can focus on running your business.

3. Do you support businesses in all industries?

Smarter Risk is especially effective for manual labor industries such as contractors, light manufacturing, warehousing, hospitality, restaurants, and hotels. The platform tailors each safety and risk control program to your specific operations, so the recommendations are always relevant to your business.

4. How much does Smarter Risk cost?

Our Intelligent Plan costs $500 per year and includes everything you need: AI-assisted risk assessment, Safety Program Builder, Forms Library, and full access to our Training Director LMS. If your insurance partner (agent or carrier) provides you with access, you may receive it for free or at a discounted rate. Your first Risk Improvement Plan is always free -- no credit card required.

5. What's included in the $500/year plan?

Everything you need to build and maintain a professional safety program:

- AI Assisted risk assessment (up to 10 locations)

- Risk Improvement organized by location

- Real-time risk score tracking

- Safety Program Builder

- Forms Library

- Training Director LMS

- Professional Risk Report you can share with insurance partners

- RISK-B AI assistant for instant safety guidance

6. What is the ROI of investing in safety?

Safety improvements directly reduce claims and lower insurance costs. Studies like the Ohio Bureau of Workers' Compensation (BWC) program show that small businesses can cut claim costs by over 80% through effective safety initiatives. Use our Safety ROI Calculator to estimate the financial impact for your business.

7. Can I share my risk report with insurers or agents?

Yes. Once your assessment is complete, you can instantly generate a Risk Report to share with your insurance partners or agent, demonstrating proactive risk management. Even if your initial score is low, you can complete the recommended actions to instantly improve your score and show measurable progress.

Assess. Improve. Share.

8. How is this different from hiring a safety consultant?

Traditional consultants cost $5,000+ for written safety programs, $150+ per location for assessments, and $250-$1,000 per employee for training -- easily exceeding $10,000 annually. Smarter Risk provides all of this for $500/year, without the complexity, scheduling hassles, or massive expense.

9. Do I need safety experience to use Smarter Risk?

No. Smarter Risk was specifically designed for business owners without safety backgrounds. Our AI-assisted assessment guides you through every step, and RISK-B (our built-in AI safety expert) provides instant answers to your questions. Everything is simplified -- no jargon, no complexity.

10. My insurance agent mentioned Smarter Risk -- how does that work?

Many insurance agencies and carriers provide Smarter Risk to their policyholders for free or at a discounted rate. If your insurance partner signed you up, wait for a welcome email from Smarter Risk that includes your partner's name and policy number. Use the link in that email -- don't sign up separately.

How Do I Get Started?

Our web-app works on any device. No download required. Click the Get Started button to get going! Complete the short form and you will receive a welcome email with a verification link and instantly start your assessment.

Would you like more information? Sign up for a demo and get all your questions answered.

Has your insurance partner signed you up? If so, please wait for an email invitation which will include your partner's name and your policy number. DO NOT SIGN UP HERE.

Make Your Business A Smarter Risk

Small businesses pay billions in insurance and claims. Don't be one of them. Join the thousands using Smarter Risk to reduce claims, lower premiums, and qualify for better rates.

Ready to Protect Your Business?

Start your risk assessment today. It takes 15 minutes and could save you thousands on your next insurance renewal.