Frequently Asked Questions

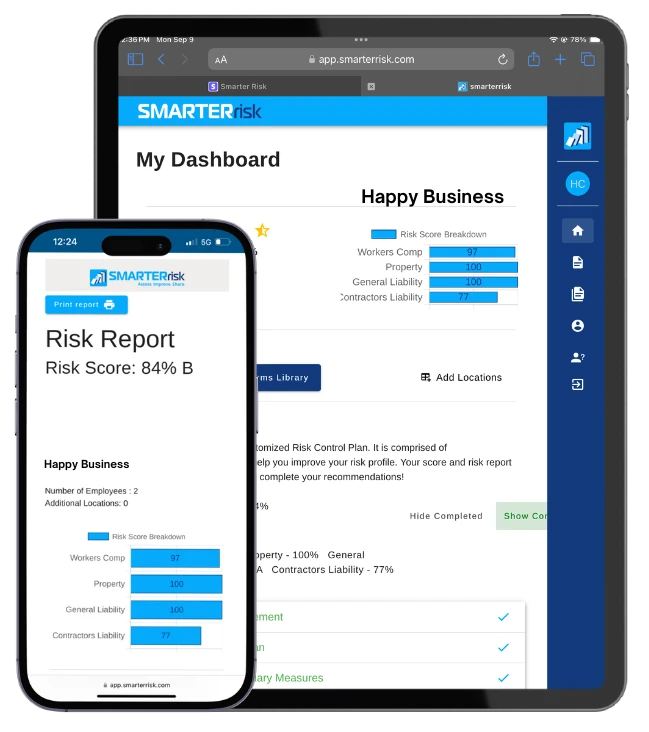

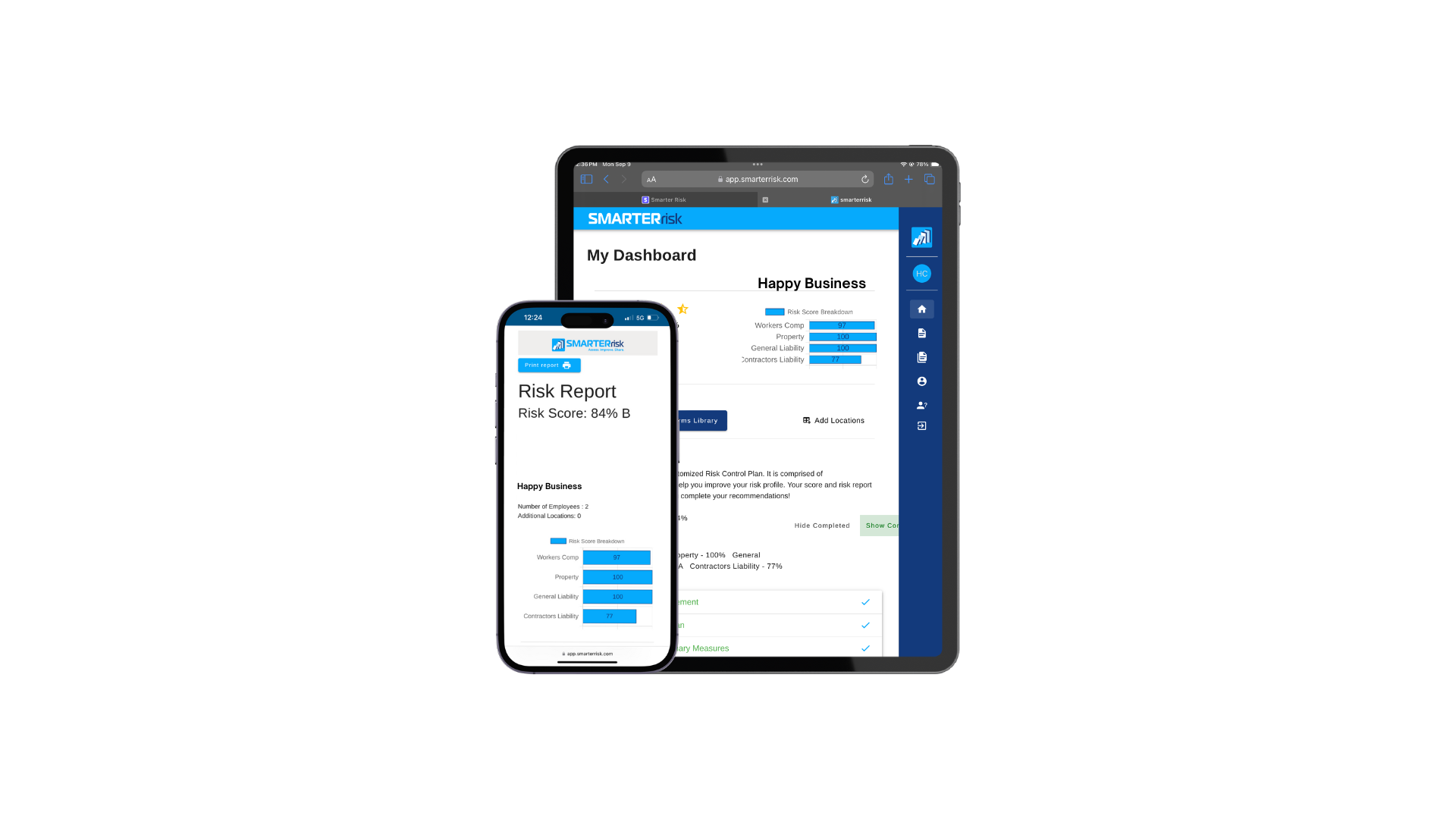

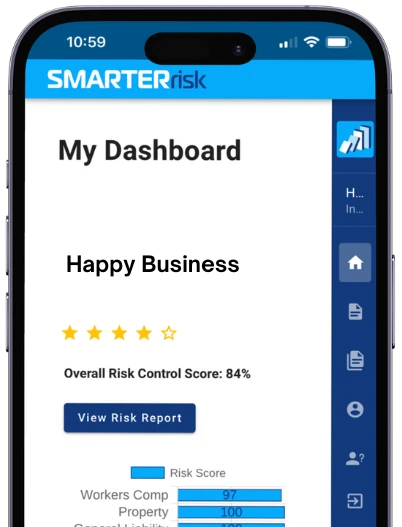

1. What is Smarter Risk?

Smarter Risk is a modern risk management platform that helps small businesses, insurance carriers, and agencies assess, improve, and document safety programs. By digitizing the risk control process, it reduces claims, improves safety performance, and helps lower insurance costs. Unlike complex enterprise systems or basic checklist apps, Smarter Risk was built specifically for small businesses in manual labor industries—contractors, shops, warehouses, manufacturing, restaurants, and hotels.

2. How long does it take to complete a risk assessment?

Our AI-assisted assessment takes just 15 minutes—not hours—to complete for your entire organization. The moment you finish, your custom risk improvement plan is generated instantly, showing you exactly what to focus on to reduce risk and improve insurability. You only need one assessment per organization—no multiple assessments or complex setup required. If you have multiple locations you can create an assessment for each one up to 10 on a single account.

3. Can I try Smarter Risk before committing?

Absolutely. Your first risk assessment is free and includes your personalized Risk Improvement Plan (a $150 value). We always recommend trying before you buy so you can see firsthand how easy it is to improve your company's safety and risk profile. Get started now with no credit card required.

4. Are safety training materials included?

Yes. Our Intelligent Plan includes full access to Training Director, our complete Learning Management System with 53 safety courses. Assign training, track completion, test knowledge, and generate compliance reports—all with unlimited seats at no additional cost. No per-user fees, no surprise charges—just complete training management for your entire team.

5. Will using Smarter Risk help lower my insurance premiums?

While we can't guarantee premium reductions, Smarter Risk helps you build, document, and maintain safety and risk control programs that insurers recognize—improving your overall risk profile and supporting better rates. Studies show that written safety programs reduce claims by 52%, lower claim costs by 80%, and decrease lost-time days by 87%. Want to estimate the potential savings? Try our Safety ROI Calculator to see the real financial impact of implementing effective safety programs.

6. How much does Smarter Risk cost?

Smarter Risk costs $500 per year—far less than a single workers' compensation claim or traditional safety consultant. There are no hidden fees, long-term contracts, or per-user charges. You get full access to risk assessments, safety program builder, and Training Director LMS with 53 courses for one flat annual fee.

7. Do I need safety experience to use Smarter Risk?

No safety expertise required. Our platform is designed for business owners and managers, not safety professionals. RISK-B, our built-in AI assistant, guides you through every step and can answer any questions about risk management or safety. Safety programs are automatically formatted to meet OSHA, NFPA, and ANSI standards—professional-grade results without the expertise.

8. Can I share my assessment results with my insurance agent or carrier?

Yes! You can generate and share comprehensive risk reports with your insurance partners. Many agents and carriers use these reports for underwriting, renewal discussions, and proving your commitment to risk management—which can lead to better rates and terms.

9. What if I need help or have questions?

RISK-B, our built-in AI assistant, is available 24/7 to answer questions about risk management, safety, or using the platform. Our AI assistant provides instant, expert guidance whenever you need it.

10. Does Smarter Risk integrate with other systems?

Smarter Risk is 100% cloud-based and doesn't require integration with payroll, HR, or other software. This means you can start using it immediately without IT involvement. Everything you need—assessments, safety programs, training, and reporting—is in one simple platform.